Overview of NFTs and the NFT Marketplace

What Are NFTs?

Non-fungible tokens, better known by their acronym, NFTs, are digitally verifiable and unique cryptographic assets that cannot be interchanged with one another. Unlike 'traditional' cryptocurrencies such as Bitcoin or Ethereum, which are fungible, or tradable without losing any inherent value, NFTs are not. Even if two NFTs come from the same collection and resemble each identically in the graphic or asset they present, other factors such as the order they were minted, who previously owned them, and more can drastically affect the price.

The NFT Ecosystem

The first NFTs were created in June of 2017, CryptoPunks, 10,000 8-bit 2D avatars created by LarvaLabs. This was the first introduction of a cryptographic asset that wasn't fully interchangeable with other similar assets, allowing for verifiable, scarce, and unique assets to live within the digital space for the first time in history. Originally free to mint (except for the cost of gas transaction fees), many CryptoPunks now regularly sell for six and seven-figure sums.

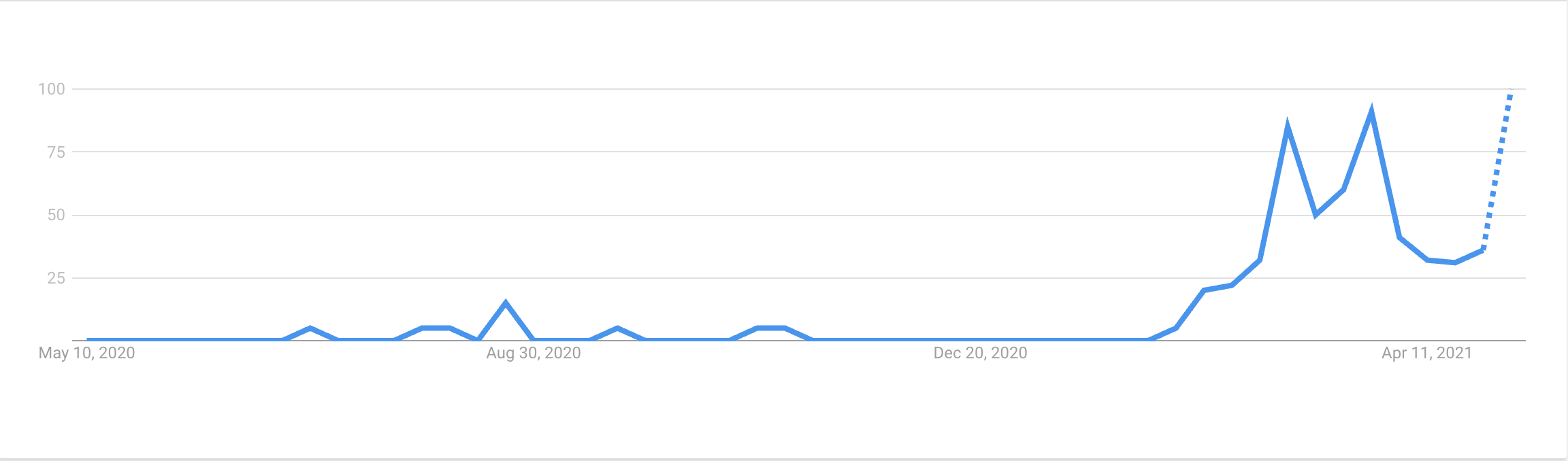

The release of CryptoPunks led to the creation of the ERC721 token standard, introducing a non-fungible token standard for minting NFTs on the Ethereum blockchain. This led to a plethora of NFTs hitting the market, such as the ever-popular CryptoKitties. From there, the NFT market continued to establish itself and develop, and in 2020, it hit an inflection point that shot NFTs into the mainstream spotlight. Many attribute this take-off to graphic artist Beeple's $69 million NFT art sale, but the underlying factors were bubbling up well before this historical sale took place.

Starting out small, the NFT market is growing, now regularly generating hundreds of millions of dollars in primary and secondary sales per month. What started as an experiment has turned into one of the most recognizable asset classes within the cryptocurrency space, with no signs of slowing down as usage and interest increase.

Last updated